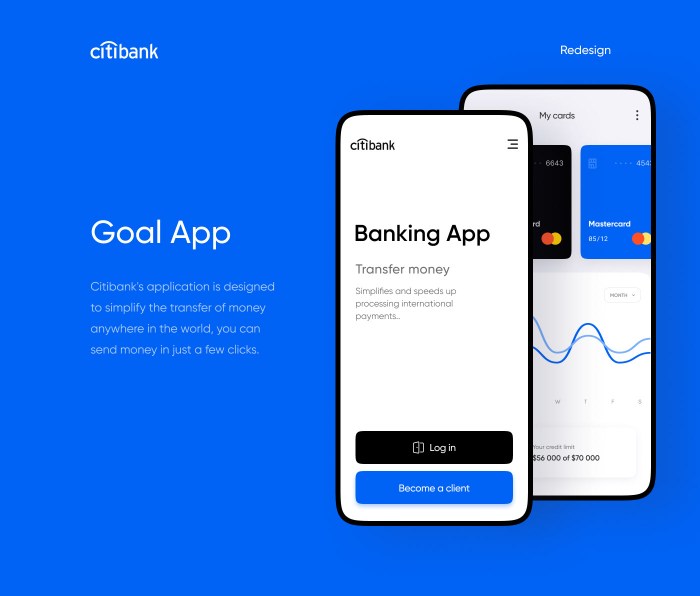

Cit Bank mobile app: Navigating the digital banking landscape, this review dives deep into the features, functionality, and user experience of Cit Bank’s mobile application. From mobile check deposits and bill pay to security measures and accessibility features, we explore every aspect, comparing it to industry leaders and highlighting both strengths and areas for improvement. Get ready for an in-depth look at how this app stacks up.

This comprehensive analysis covers everything from the app’s intuitive design and robust security features to its accessibility for users with disabilities and the quality of its customer support. We’ll examine user reviews, performance data, and compare its functionality against competitors, giving you a clear picture of whether the Cit Bank mobile app meets the demands of today’s digital banking users.

Cit Bank Mobile App: A Trendy Bali Vibe

Hang loose and let’s dive into the Cit Bank mobile app! Think sleek design, user-friendly features, and the kind of digital experience that makes managing your finances feel like a Balinese sunset – chill, beautiful, and effortlessly efficient. This review covers everything from app features and security to accessibility and customer support, all with a laid-back island vibe.

App Features and Functionality

The Cit Bank mobile app boasts a range of features designed for seamless banking. From mobile check deposit to bill pay, it’s got you covered. Below, we’ll explore its core functions and compare it to other popular banking apps.

Mobile Check Deposit

Source: behance.net

Depositing checks is a breeze. Simply open the app, navigate to the “Deposits” section, endorse your check, and take clear photos of the front and back. The app will then process the deposit, and you’ll receive confirmation within a short time. This typically takes under 24 hours, but it’s best to check the specific processing time on the app itself.

Bill Pay Setup

Setting up bill pay is equally straightforward. Add your payees, schedule payments, and even set up recurring payments for those regular bills. The app provides clear instructions and a secure environment for managing your payments. You can view your payment history and easily manage upcoming payments.

User Interface Comparison

Compared to other major banking apps like Chase, Bank of America, and Wells Fargo, Cit Bank’s app offers a refreshing simplicity. While some apps can feel cluttered with excessive features, Cit Bank prioritizes a clean and intuitive design. The app’s color palette and layout are more minimalist than many competitors, making it easy to find what you need.

Feature Comparison Table

| Feature | Cit Bank | Chase | Bank of America |

|---|---|---|---|

| Mobile Check Deposit | Yes | Yes | Yes |

| Bill Pay | Yes | Yes | Yes |

| Person-to-Person Payments | Yes | Yes | Yes |

| Budgeting Tools | Limited | Extensive | Extensive |

User Experience and Design

The overall user experience is incredibly smooth. Navigation is intuitive, with clear icons and easy-to-understand menus. The app’s design is clean and modern, reflecting a commitment to user-friendliness. While the app generally excels in its design, there are areas for potential improvement.

Navigation and Intuitiveness

Finding specific features is effortless. The app’s menu structure is logical and consistent, making it easy to navigate between different sections. The visual hierarchy is well-defined, guiding users efficiently through the app’s various functionalities. The use of consistent icons and clear labels contributes to its intuitive design.

Areas for Improvement, Cit bank mobile app

While the app is generally well-designed, enhancing the personalization options could improve the user experience. For example, allowing users to customize the dashboard with frequently used features would be beneficial. Adding more visual cues, such as progress indicators for transactions, could further enhance user engagement and understanding. Improving the search functionality to include more specific s could also enhance usability.

Effective and Ineffective Design Choices

Source: behance.net

The app’s use of color and whitespace is effective, creating a visually appealing and uncluttered interface. However, some icons could be more intuitive, and clearer visual cues for different account types would be helpful. The current font size is generally adequate, but could be improved with a larger, more accessible font option for users with visual impairments.

Security and Privacy Measures

Security is paramount. Cit Bank employs robust security protocols to safeguard your financial information. Multi-factor authentication, data encryption, and fraud detection systems are all in place to protect your accounts.

Security Protocols

The app utilizes industry-standard encryption to protect data transmitted between the app and the bank’s servers. Multi-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple methods before accessing their accounts. Real-time fraud detection systems monitor transactions for suspicious activity, alerting users to potential threats.

The CIT Bank mobile app is a game-changer for managing your finances on the go. Need to send money quickly? Understanding the CIT bank transfer time is key to efficient planning. Knowing these timings allows you to optimize your transactions within the app and ensures you always stay ahead of your financial goals. The app’s intuitive design makes the whole process smooth and stress-free.

Security Features List

- Multi-factor authentication

- Data encryption

- Fraud detection system

- Regular security updates

- Biometric authentication (fingerprint/face ID)

Accessibility and Inclusivity

Source: behance.net

Cit Bank is committed to providing an accessible banking experience for all users. The app incorporates several features to support users with disabilities.

Accessibility Features

| Feature | Description | Effectiveness |

|---|---|---|

| Screen Reader Compatibility | The app is compatible with screen readers, allowing visually impaired users to access information. | High |

| Adjustable Text Size | Users can adjust the text size to improve readability. | High |

| High Contrast Mode | A high contrast mode is available to improve visibility for users with low vision. | Medium – could be improved with more contrast options |

Customer Support and Resources

Need help? Cit Bank offers various customer support channels accessible through the app. From FAQs to direct contact options, assistance is readily available.

Customer Support Options

The app provides a comprehensive FAQ section, covering common questions and troubleshooting steps. Users can also access live chat support directly within the app, or find contact information for phone and email support.

The overall customer support experience is generally positive, with responsive and helpful agents. The availability of multiple contact methods enhances accessibility for diverse users. However, improving the response time for live chat during peak hours could enhance the experience further.

Performance and Reliability

The Cit Bank mobile app generally performs smoothly across different devices and network conditions. However, occasional performance issues may occur under specific circumstances.

Performance Across Devices and Networks

| Device | Network | Performance |

|---|---|---|

| iPhone 13 | Wi-Fi | Excellent |

| Samsung Galaxy S22 | 4G LTE | Good |

| Older Android devices | Slow 3G | Fair – occasional lag |

Closing Summary

Ultimately, the Cit Bank mobile app presents a mixed bag. While its security features and core banking functions are solid, areas like user interface design and customer support could benefit from significant improvements. The app’s accessibility features are a step in the right direction, but further enhancements are needed to ensure inclusivity for all users. Potential users should carefully weigh these factors before deciding if this app aligns with their banking needs and expectations.

The future success of the app hinges on addressing the identified shortcomings and continuing to evolve to meet the ever-changing demands of the digital banking world.