SoFi vs CIT Bank: Choosing the right financial institution hinges on understanding the nuances of their offerings. This comparative analysis dissects key features, fees, customer service, security measures, and loan products (where applicable), providing a data-driven perspective to aid informed decision-making. We’ll delve into the specifics of checking and savings accounts, investment options, and the overall user experience, examining both the strengths and weaknesses of each institution to illuminate the best fit for your individual financial needs.

The modern financial landscape offers a diverse range of institutions, each vying for customer loyalty with unique features and service models. This in-depth comparison of SoFi and CIT Bank aims to clarify the differences between these two prominent players, empowering consumers to make educated choices based on their priorities. By systematically examining account types, fees, customer support, security protocols, and loan offerings, we aim to provide a clear and comprehensive understanding of the advantages and disadvantages of each institution.

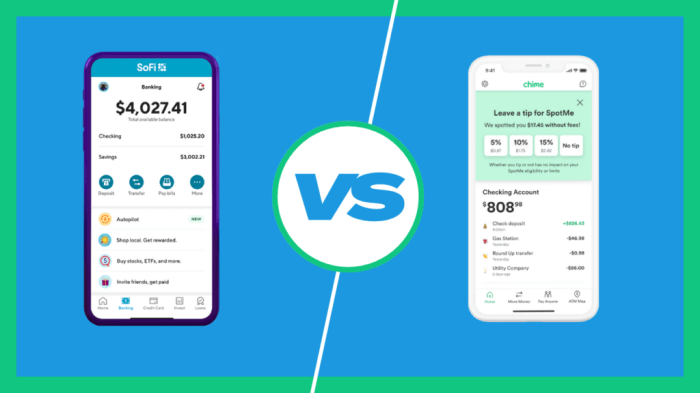

SoFi vs. CIT Bank: A Detailed Comparison: Sofi Vs Cit Bank

Source: thesmartinvestor.com

Choosing the right financial institution can significantly impact your financial well-being. This comprehensive comparison analyzes SoFi and CIT Bank across key aspects, helping you make an informed decision based on your individual needs and preferences. We’ll examine account types, fees, customer service, security, and loan products (where applicable), offering a clear and concise overview of each institution’s strengths and weaknesses.

Account Types and Features

This section details the checking, savings, and investment account options offered by SoFi and CIT Bank, highlighting key differences in features and benefits.

Checking Account Comparison

| Feature | SoFi | CIT Bank | Notes |

|---|---|---|---|

| Monthly Fee | Generally none with qualifying conditions | May vary depending on account type | Check specific account terms for details. |

| Overdraft Protection | Offered, terms and fees apply | Offered, terms and fees apply | Fees and protection levels can differ significantly. |

| ATM Access | Access to Allpoint ATM network; fees may apply for out-of-network ATMs. | Access to various networks; fees may apply for out-of-network ATMs. | Review ATM fee policies carefully. |

| Mobile Check Deposit | Yes | Yes | Both offer convenient mobile deposit functionality. |

Savings Account Comparison

A critical aspect of choosing a bank involves understanding the savings account options. Interest rates and minimum balance requirements significantly impact your returns.

- SoFi Savings Account: Typically offers competitive interest rates, often higher than traditional brick-and-mortar banks, with minimal or no minimum balance requirements.

- CIT Bank Savings Account: Offers a range of savings accounts with varying interest rates and minimum balance requirements. Some accounts may require higher minimum balances to earn higher interest rates.

Investment Account Comparison

| Account Type | SoFi Details | CIT Bank Details | Key Differences |

|---|---|---|---|

| Brokerage Accounts | Wide range of investment options, including stocks, ETFs, and options; generally low or no fees for trading. | May offer brokerage services through partnerships or integrations; fee structures may vary. | SoFi often presents a more integrated and streamlined investment platform. |

| Retirement Accounts (IRAs) | Traditional and Roth IRAs available; investment options similar to brokerage accounts. | May offer IRA options; check for specific investment choices and fee structures. | Investment options and fee structures should be carefully compared. |

Fees and Charges

Understanding fee structures is crucial for managing your finances effectively. This section details the fees associated with checking, savings, and investment accounts at both institutions.

| Fee Type | SoFi vs CIT Bank |

|---|---|

| Monthly Maintenance Fees | SoFi generally waives fees with qualifying conditions; CIT Bank may charge monthly fees depending on the account type. |

| Overdraft Fees | Both banks charge overdraft fees; specific amounts vary depending on the account and the overdraft amount. |

| ATM Fees | SoFi charges for out-of-network ATM withdrawals; CIT Bank’s policies vary by account type. |

| Investment Fees | SoFi typically has lower trading fees compared to CIT Bank, which may have higher fees or rely on partner brokerage fees. |

SoFi Fees: SoFi’s fee structure is generally transparent, but be aware of potential fees for out-of-network ATM use and potential overdraft charges.

So, Sofi vs Cit Bank? It’s a tough one, depends on your needs, right? But today’s making the decision even harder because, get this, I just saw that the cit bank website down today ! Major bummer if you were trying to compare accounts. Anyway, back to Sofi vs Cit Bank – gotta weigh the pros and cons carefully!

CIT Bank Fees: CIT Bank’s fee structure can be more complex, with potential monthly maintenance fees and varying ATM fees depending on the account. Carefully review the fee schedule for your chosen account type.

Hidden fees are less common with both institutions due to their online-focused models, but always review the terms and conditions for any unexpected charges.

Customer Service and Accessibility

Effective customer service and accessible banking platforms are vital for a positive banking experience. This section compares the customer service channels and online/mobile banking platforms of SoFi and CIT Bank.

- Customer Service Channels: Both SoFi and CIT Bank offer phone support, online chat, and email support. In-person branches are not available for SoFi, while CIT Bank may have limited branch locations.

- Online/Mobile Banking: Both banks provide user-friendly online and mobile banking platforms with intuitive navigation and comprehensive account management features. SoFi’s platform is generally praised for its modern design and seamless integration of various financial services.

- Customer Service Responsiveness: Online reviews suggest that both institutions generally provide responsive customer service, though individual experiences may vary. SoFi’s online support system is often highlighted for its efficiency.

Security Measures, Sofi vs cit bank

Protecting your financial information is paramount. This section compares the security measures implemented by SoFi and CIT Bank.

| Security Feature | SoFi vs CIT Bank |

|---|---|

| Data Encryption | Both utilize robust encryption protocols (e.g., SSL/TLS) to protect data transmitted online. |

| Two-Factor Authentication (2FA) | Both offer 2FA for enhanced account security. |

| Fraud Monitoring | Both actively monitor accounts for suspicious activity and provide alerts to customers. |

SoFi Fraud Protection: SoFi employs sophisticated fraud detection systems and proactively monitors accounts for unauthorized transactions. They offer alerts and tools to help customers identify and report suspicious activity.

CIT Bank Fraud Protection: CIT Bank also utilizes advanced fraud detection technologies and provides customers with tools and resources to protect their accounts from fraudulent activity. They offer alerts and methods for reporting suspicious transactions.

Loan Products

Both SoFi and CIT Bank offer various loan products. This section focuses on personal loans and mortgages (if offered by both), highlighting key differences.

Personal Loans

| Loan Type | SoFi Details | CIT Bank Details | Key Differences |

|---|---|---|---|

| Personal Loans | Competitive interest rates, various loan amounts and terms; online application process. | Interest rates and terms may vary; application process may involve more traditional methods. | SoFi often emphasizes a streamlined, online-focused application and approval process. |

Mortgages

- SoFi Mortgages: SoFi offers a range of mortgage products, including conventional, FHA, and VA loans. They often emphasize a digital-first approach to the mortgage process.

- CIT Bank Mortgages: CIT Bank also provides mortgage options; specific details regarding rates, fees, and eligibility requirements should be obtained directly from CIT Bank.

Ultimate Conclusion

Source: creditmashup.com

Ultimately, the “better” institution between SoFi and CIT Bank depends entirely on individual financial circumstances and priorities. SoFi shines with its technologically advanced platform and diverse offerings, particularly for younger, tech-savvy individuals. CIT Bank, on the other hand, may appeal more to those seeking traditional banking services with a focus on straightforward accounts and potentially competitive interest rates. By carefully weighing the factors discussed – account features, fees, customer service, security, and loan products – consumers can make an informed decision aligned with their specific needs and financial goals.

A thorough assessment of each bank’s strengths and weaknesses is paramount to selecting the optimal financial partner.